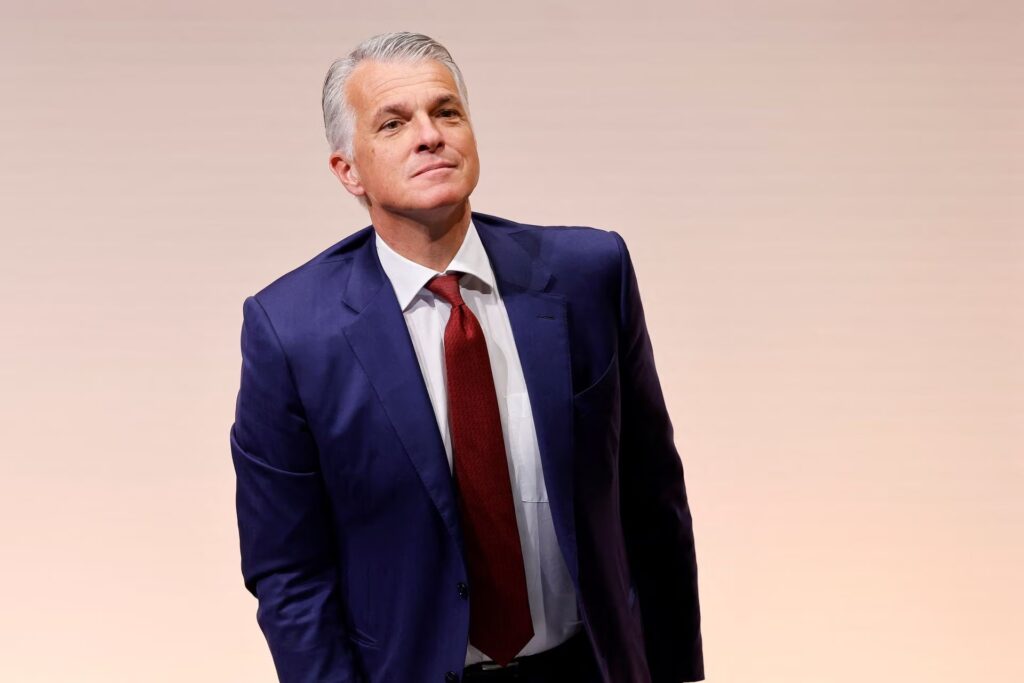

UBS (UBSG.S) CEO Sergio Ermotti is facing an Asian wealth bonanza after acquiring Credit Suisse, which has been particularly strong in Indonesia and neighbouring countries. The Swiss executive will however have to tread carefully as he integrates a damaged business that thrived on serving risk-taking entrepreneurial customers.

The shotgun marriage with Credit Suisse, formally sealed in June, will consolidate UBS’s position as the leading bank for the rich in the region, especially in fast-growing Southeast Asia – home to about 675 million people. For the past decade, Credit Suisse shaped itself as the private bank of choice for local entrepreneurs, offering local tycoons share-backed financing and complex loan structures, as well as a path to debt issuance and listings for their companies.

Tidjane Thiam, who ran Credit Suisse from 2015 to 2020, placed a big bet on the region by creating a standalone Asian unit led by Indonesian banker Helman Sitohang. Former UBS CEO Ralph Hamers said in March that in Asia, more than anywhere globally, the interplay between wealth management and investment banking was important to lure clients.

That working combination helped Credit Suisse regularly top equity capital markets and M&A league tables in Southeast Asian markets. But as the end of cheap money fuels a shakeout in company valuations, the risk appetite of entrepreneurs has diminished, while fear of an imminent collapse prompted many to leave Credit Suisse’s floundering franchise last year.

That poses a problem for UBS. Credit Suisse’s assets under management dropped 28% year-on-year to around $170 billion in Asia at the end of 2022 as concerns about its stability scared off clients, estimates from finnews.asia show. UBS regional chief Edmund Koh told an industry event in July that the Swiss bank will manage about $800 billion of assets in Asia this year, Asia Private Banker reported. Yet, the combined clients’ wealth managed by the two groups in the region was just $610 billion at the end of 2022, and more money left Credit Suisse in the weeks leading to its frantic March rescue.

Even though the regional wealth of the enlarged UBS is three times that of its most immediate competitor, HSBC (HSBA.L), (0005.HK), Ermotti knows some of the assets remain at flight risk as anxious clients look to diversify investments or follow bankers who have left the Swiss bank.

Rebuilding lost wealth is hard. That’s why the CEO has wisely retained some Credit Suisse senior Asia private bankers such as Francesco De Ferrari and Benjamin Cavalli and is offering chunky incentives to advisers who can woo rich clients back. In contrast with his decision to shrink the investment bank globally, Ermotti will also retain at least a hundred investment bankers in the region.

For UBS, shoring up dominance in Asia could be a complex and costly affair.

Source : Reuters